|

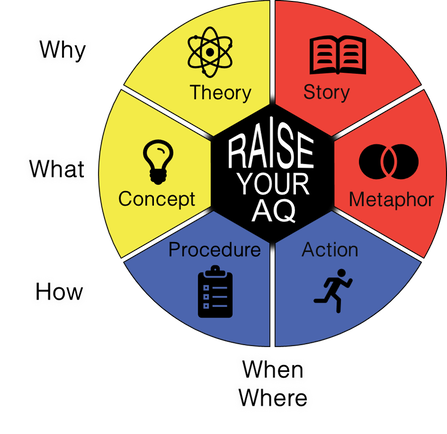

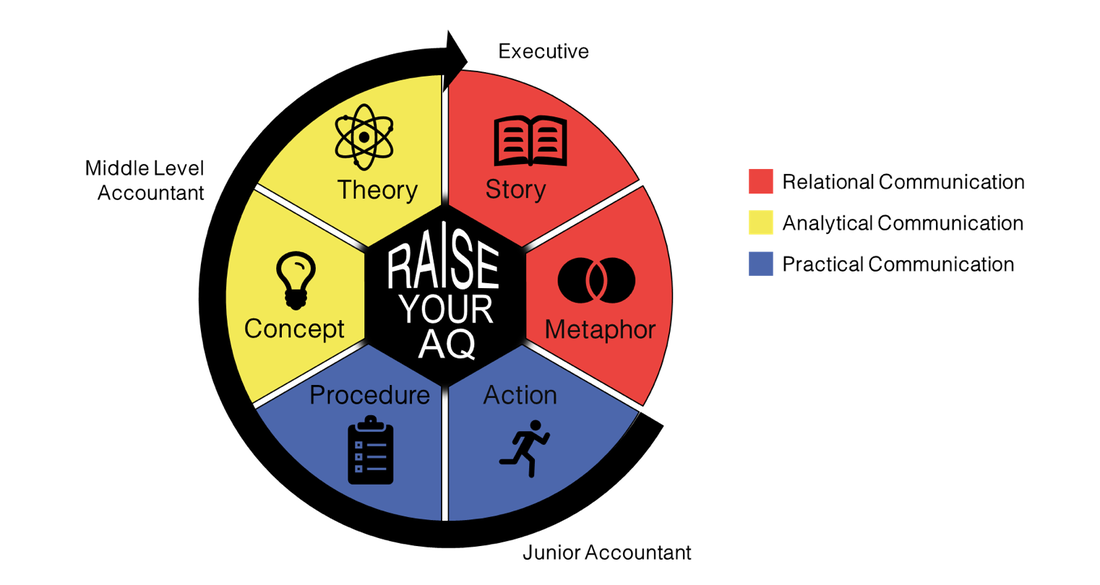

Mike Soenke is an Executive in Residence at North Central College (Naperville, IL, USA) and retired DOW 30 SVP and USA CFO. In this two-part series, Mike and I discuss Answer Intelligence (AQ)® based upon his experience as a former executive at a DOW 30 corporation. The focus of this blog post (2 of 2) is using AQ to elevate your career. The prior post focused upon using AQ to elevate your organization. The following interview is edited for clarity. This article is part of the High AQ Interview Series where executives, academics, and thought leaders discuss elevated answers. Using AQ to Elevate Your CareerDr. G: “As you look at the Answer Intelligence (AQ)® framework, can you describe its significance to a finance professional?” Mike Soenke: “The single biggest opportunity related to a leadership competency throughout the finance function was the ability to influence key stakeholders. AQ is an influence framework.” Dr. G: “When you were U.S. CFO of a DOW 30 organization, can you discuss how finance professionals typically improved their ability to influence over time?” Mike Soenke: “Out of college, finance staff are technically proficient doers. In AQ terms, they focus on the practical style (procedures and actions). A lot of finance staff can communicate in blue [the practical style] describing the financial standards guiding their work. When better finance staff progress, they start to work with people across the business … if all they can do is recite the standards they will not go very far… a lot of business people will get frustrated. For example, a business person may say, ‘I don’t understand why we can’t do X, Y, or Z to recognize more revenue.’ Better finance professionals will be able to get into the analytical skill and use concept and theory to clearly explain the purpose behind a standard and why it makes sense. Moreover, the more skilled communicators can translate finance into layman terms so that a non-technical person can easily understand. Theory and concept knowledge extends to business strategy and broader principles of finance as one progresses in finance. For example, a strong financial leader would proactively influence the right financial discipline: ‘We want to do X, Y, or Z to increase shareholder value… or we will not get the return that meets or exceeds the cost of capital so the enterprise value will erode if we make this decision.’ Relational communication, story and metaphor, is the capstone for financial and really all business leaders. As I mentioned earlier, finance is initially steeped in action and process [Practical style], and many can stretch to theory and concept, but only the expert level financial leader can excel at stories and metaphors to maximize their influence. For example, throughout my career I often had to influence independent franchise owners to support company initiatives through investment in labor, food cost, marketing or longer-term capital improvements. In addition to providing a data driven business case you often had to find a way to emotionally engage them with metaphors and stories of success to create system alignment. For example, I would often have a franchisee leader passionately share their story of customer satisfaction and financial success in support of the broader initiative … I wanted to pull people in and create enthusiastic system-wide support. There is a lot of skill in getting stories and metaphors right. While I preferred to use positive stories to inspire action, there were times when painting a negative picture of the future absent bold actions was equally or more impactful.” Answer Progression from Junior Accountant to Executive Dr. G: “You make a compelling case for a progression toward the relational style. Can you tell me a little bit about how an expert finance communicator, who has mastered story and metaphor, also weaves in the other answer modes?” Mike Soenke: “Of course, as I’m telling the story, I’m weaving in the theory and concept, and I would discuss procedures and actions associated with the story that a franchisee executed against to achieve success. Therefore, one story can be a touchstone for all the other six answer types. A skilled communicator can start with procedures... outlining the rules were not followed, and then pivot to a story of failure to drive home the consequences of not following the rules. Also, an effective story must be constructed to support your theory and concepts. For example, if there are three initiatives [key strategies; or concepts/theories in AQ terms] I might emphasize the synergies in emphasizing all three initiatives at the same time in the story, to inspire them to go after all three to generate incremental cash flow to make customers happy.” Dr. G: “Why do you think all finance professionals are not able to be effective relational communicators (using stories and metaphors)?” Mike Soenke: “Two things. First, people gravitate to a field like finance, or software development, because they are more technical in their knowledge base. Finance professionals are more introverted and communicating with stories and metaphors does not come naturally to many. This means individuals are more comfortable in the practical style of communication. Second, during my career, finance professionals did not have a thought framework to build out the different communication skills. Yes, we knew stories could be effective to engage, and we had an inventory of metaphors, but we did not have an organizational framework to make sense of all six answer types and map these answers to questions. In addition to an organizing framework, we did not have a roadmap to build out our communication competency in a layered manner. Using AQ and the 5 practice areas, it is possible to build communication skills over time in a thoughtful manner." Dr. G: “You’ve discussed that finance professionals progress in their career from practical, to analytical, to relational influence. Does the sequence of progression follow this pattern outside of finance?” Mike Soenke: “For different functions, or even for specific individuals within finance, the sequence of progression could be different. It might be a given professionals can tell stories and metaphors, but they don’t have concepts or theories behind them, or the ability to execute with procedures and actions is lacking. Therefore, it is possible for the process to be reversed in certain professionals.” High AQ Takeaway: According to Mike Soenke, finance professionals (and other technical professionals) will first provide influence with practical communication (procedure + action). Then, those that progress in their career master analytical communication (concept + theory). Finally, those that aspire to become executives will need to develop relational communication skills (story + metaphor). If you found Answer Intelligence (AQ)® an interesting framework, please share this post with others.

0 Comments

Leave a Reply. |

Access Octomono Masonry Settings

AuthorDr. Brian Glibkowski is the author of Answer Intelligence: Raise your AQ. Archives

October 2022

Categories

All

|

About AQ

Answer Intelligence (AQ)™ is the ability to provide elevated answers to explain and predict in a complex world, emotionally connect, and achieve results. Are you conversation ready?

Meet HarperHarper's story illustrates the transformative power of AQ in her own career and in the success of her organization.

|

AQ Upskilling PlatformAI is machine thinking. AQ is human thinking (developed based on academic research) in terms of simple questions (why, what, how, when, where, who) and answers (concept, metaphor, theory, story, procedure, action) that elevate human-to-AI and human-to-human communication.

|

Quick Access LinksBuy the Book

Explore AQ (Free Assessment) AQ TEDx Video Professional Services Firms + AQ Brian Glibkowski, PhD - AQ Creator Meet Harper - Overview Video Meet Mark - Software Case Reasons You Need AQ |

Featured |

RSS Feed

RSS Feed